How Associations and Property Managers Can Fight Fraud in 2026: Essential Strategies to Protect Your Communities

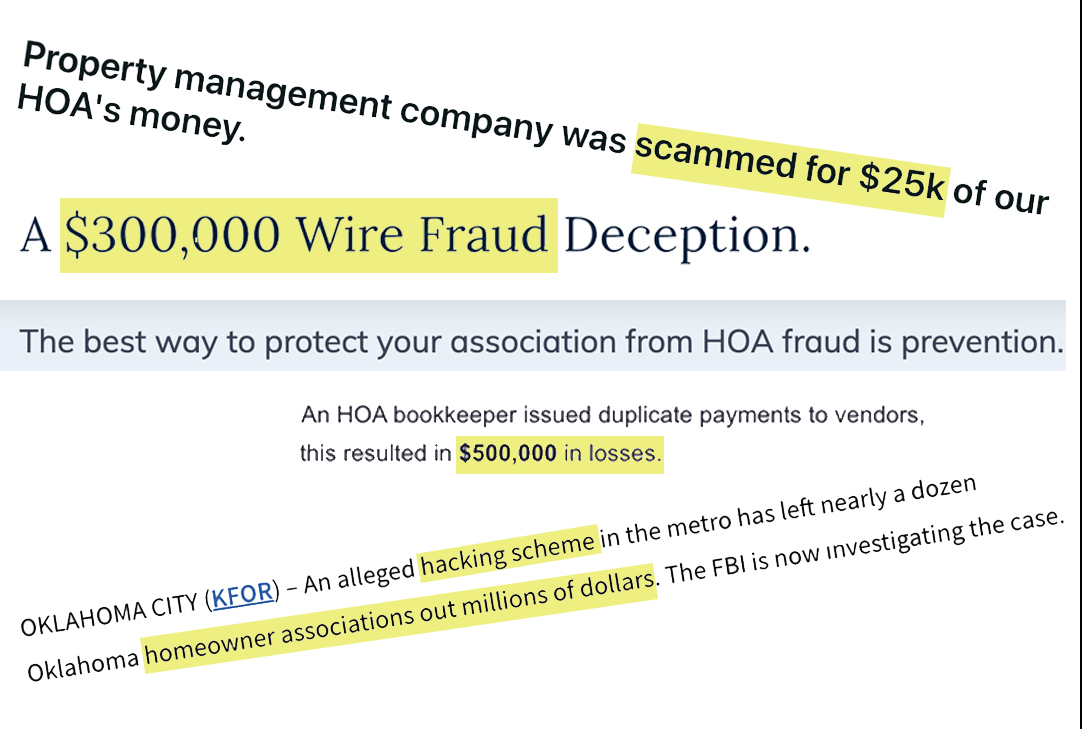

Fraud in the property management industry is accelerating at a pace the sector has never seen before. With increasing digital transactions, complex financial workflows, and evolving criminal tactics, both community associations and property managers today face more exposure than ever. The good news? With the right systems, verification methods, and internal controls, you can significantly reduce your risk.

Below, we break down why both community associations and property managers are increasingly targeted for fraud—and the top strategies you can implement to protect your communities, your owners, and your business.

Why Property Management Is Increasingly Targeted for Fraud

Property management has become a hotspot for fraud in recent years. Here’s why:

- High Payment Volume Creates Opportunity

Assessments, deposits, utility payments, vendor invoices—associations and property managers process an enormous flow of money daily. Fraudsters know that high volume makes it easier for unauthorized transactions to blend in unnoticed.

- Outdated or Mixed Payment Methods

Paper checks, cash deposits, and peer‑to‑peer (P2P) payment apps (like Zelle and Cash App) remain common in the industry. Unfortunately, these are among the easiest methods to exploit—checks can be stolen, forged, or altered, and P2P apps often favor the payer in disputes.

- Multiple Stakeholders = More Attack Surfaces

Managers routinely communicate with tenants, owners, vendors, board members, and others. Each one represents a new vulnerability for:

- Email spoofing

- Vendor impersonation

- Redirected payments

- Social engineering attacks

- Email Is Vulnerable to Cybercrime

Business Email Compromise (BEC) and phishing attacks frequently target association board members and property managers because email is still widely used for:

- Approving payments

- Updating banking information

- Requesting refunds

- Authorizing vendor changes

Criminals are even using deepfake audio to impersonate owners and executives.

- Small Teams Often Lack Internal Controls

In many smaller self-managed communities and property management companies, a single person might oversee accounting, payments, vendor communication, and approval processes—creating risky single points of failure.

- High‑Value Payments Make Fraud Worthwhile

Assessments, payments, and owner disbursements often involve thousands of dollars at a time. That makes successful fraud attempts particularly profitable, motivating criminals to target the industry.

How Property Managers Can Fight Fraud (And Win)

Understanding the risks is only step one. Here’s how property managers can proactively combat fraud.

- Transition Away from Paper Checks

Paper checks are the top target for payment fraud. Switching to secure digital payment systems like VendorShield:

- Reduces check theft

- Eliminates forgery risks

- Keeps records transparent

- Adds multiple layers of encryption and authentication

Digital payments are faster, safer, and more verifiable.

- Use Secure Digital Payment Platforms

Not all digital payments are equal. Consumer apps (like Venmo or PayPal) favor the payer, creating dispute risks.

Instead, platforms built for property management often include:

- Encrypted transactions

- Role‑based permissions

- Real‑time account validation

- Audit trails

- Automatic receipts

These platforms dramatically reduce unauthorized withdrawals and chargebacks.

- Implement Multi‑Step Approval Workflows

Single-approver systems are no longer safe.

Add controls such as:

- Dual approval for payments

- Verification before bank changes

- Supervisory review for large transactions

This stops both fraud and impersonation attempts.

- Protect Your Communication Channels

Stop approving financial decisions via email or text.

Instead:

- Use secure portals

- Require login authentication

- Train staff to identify phishing attempts

- Confirm suspicious requests with a phone call

- Use secure software platforms like those provided by Denali and MyPropertyBilling.com.

A simple phone verification step has prevented countless fraud attempts.

- Reconcile Accounts Frequently

Regular audits and financial reports like those made available on software platforms offered by Denali and MyPropertyBilling.com can help catch:

- Duplicate payments

- Unauthorized transfers

- ACH disputes

- Unexpected chargebacks

The shorter the gap between reviews, the faster you can catch fraud.

- Maintain Thorough Records

Comprehensive documentation helps in:

- Chargeback disputes

- Legal defenses

- Internal audits

- Reconciling bank activity

Keep organized digital records of:

- Leases

- Payment logs

- Vendor invoices

- Communication threads

- Approval workflows

- Train Your Team—Regularly

Employees are the first line of defense against fraud. That is why Denali Property Management and MyPropertyBilling.com employees and constantly receiving education that helps them spot:

- Phishing

- Suspicious bank changes

- Urgent payment requests

- Unusual email patterns

Our well‑trained staff drastically reduces your fraud exposure.

Final Thoughts: A Strong Defense Is Layered

Fraud is evolving, but so can your defenses. Property managers who combine strong technology, policies, and employee training dramatically reduce the risk of financial loss.

By modernizing payment workflows, strengthening screening processes, and building a vigilant organizational culture, you can protect your clients—and your communities—with confidence.